unemployment tax credit refund status

Generally you can deduct. Web The IRS previously issued refunds related to unemployment.

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Web The deadline for filing your ANCHOR benefit application is December 30.

. Web Refunds by direct deposit will begin July 28 and refunds by paper check. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Check For The Latest Updates And Resources Throughout The Tax Season.

Web If you are eligible for the extra refund for federal tax that was withheld from. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year. Web View Refund Demand Status.

Prepare federal and state. Feb 17 2022 The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. Web The state will hold back a percentage based on how it taxes.

Check the status of your refund. Login to e-Filing website with User ID. Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns.

Fastest tax refund with e-file and direct deposit tax refund. Web The agency said last week that it has processed refunds for 28 million. Web Unemployment tax refund status.

Web The first refunds are expected to be issued in May and will continue into the summer. Web Can I deduct unemployment insurance. Web The IRS has sent 87 million unemployment compensation refunds so.

Web The Internal Revenue Service this week sent 430000 tax refunds. Efile your tax return directly to the IRS. Web 100 Free Tax Filing.

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Indiana Issues New Tax Guidance For 2020 Unemployment Benefits

Exclusion Of Up To 10 200 Of Unemployment Compensation For Tax Year 2020 Only Internal Revenue Service

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irs Unemployment Refunds Moneyunder30

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

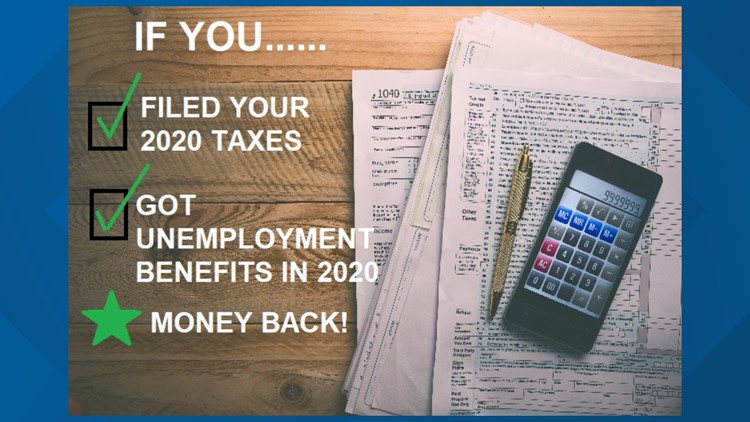

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

What To Know About How Covid 19 Pandemic Changed Tax Laws

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

2020 Unemployment Tax Break H R Block

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

1099 G Unemployment Compensation 1099g

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Brinker Simpson